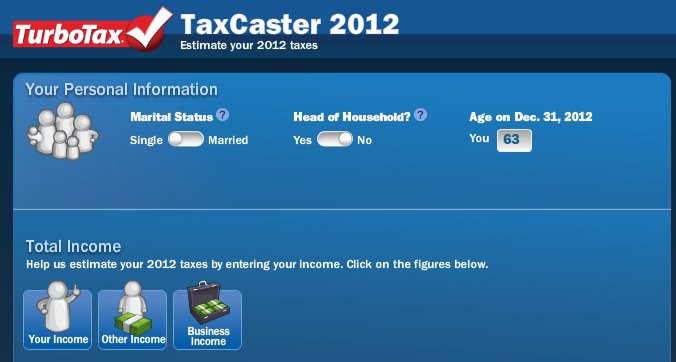

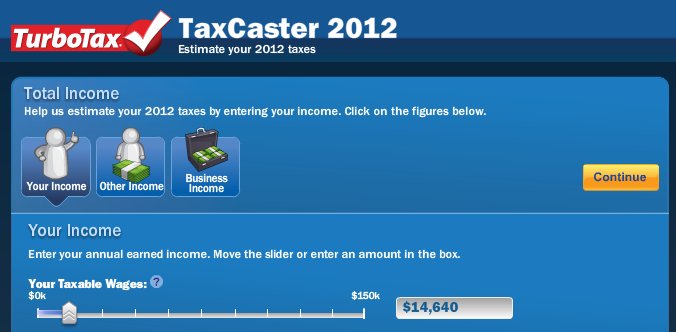

Tax Caster Example - The WallThe following is an example of the effect of an additional $1,000 of earned income when you are receiving social security benefits prior to your normal retirement age. It illustrates an absolutely unbelievable tax and penalty federal rate of over 98%. Step 1: Just fill in your age as 63, then click "Your

Income". Step 2: Enter your earned income wages as $14,640, then

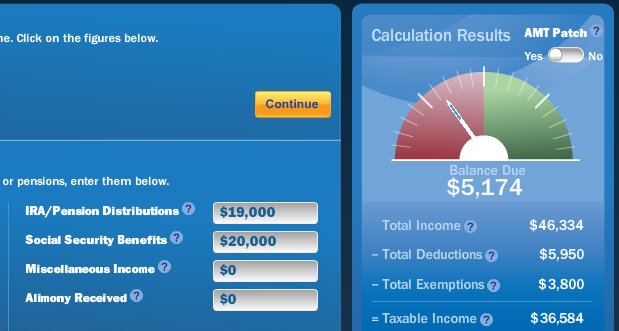

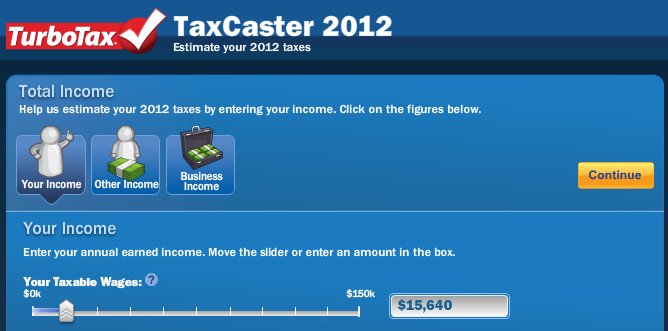

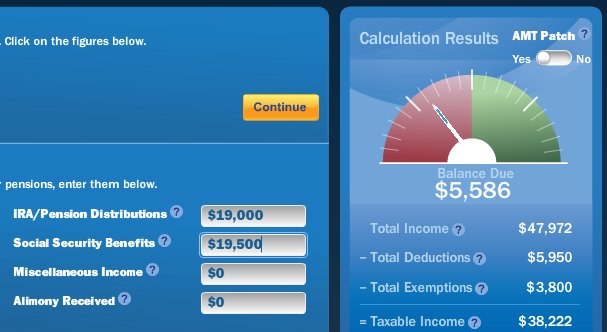

click "Other Income". Step 3: Enter your IRA/Pension Distribution as $19,000 Take note that your Balance Due is $5,174, then change your entries to reflect an additional $1,000 of earned income wages which will result in a $500 government take back of your Social Security Benefit. Step 4: Change your wages to $15,640 Step 5: Change your Social Security Benefit to $19,500

Your Balanced due is now $5,586. You increased your earned income $1,000 for which you are paying $412 in additional federal income tax. But you are also giving back $500 in Social Security Benefits, so that brings your cost to $912. Since this is earned income you are also paying OASDI withholding of $62 plus Medicare taxes of $14.50. This brings your total taxes and take backs up to $988.50 or 98.85%, and this percentage does not include any state or local taxes.

And I just have to say it one more time; if you include state and local taxes, you literally have to pay the government for the privilege of working harder. And, this example happens when your gross income is just $53,640 ! |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||