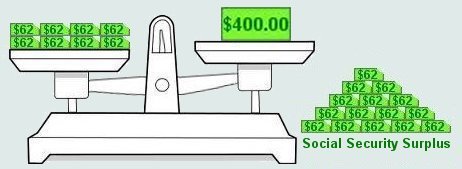

The ProblemThe Social Security system was originally created to work something like a balance scale where money in equals money out. From the very onset of the system, the money out was not restricted to merely retirement checks. Small bites of the money were set aside for other benefits like aid to dependent children.  When congress realized that the eventual retirement of the baby boomers was going to bankrupt the system, they started collecting more than they needed to meet the current money out demands. This created the Social Security surplus account that we constantly hear about today.

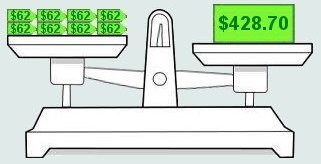

And the out of balance situation gets worse every year! So far we have only discussed problems with the supply side of the scale. The 1983 Social Security Reform Act realized that the real problem was on the demand side. Average life expectancy in 1983 was 74.5 and the retirement age was 65. Basically, the average American would receive benefit checks for 9.5 years. Based on the 1983 legislation the 2012 retirement age is now 66, but life expectancy is now 79 so the average American will now receive benefit checks for 13 years. By 2027 the standard retirement age will be 67, but what will life expectancy be, and how many years will the system need to make benefit payments?  Increasing life expectancy tips the balance scale to the payout side and there are only two ways to re-balance it: increase the retirement age or increase the OASDI contribution. The 1983 legislation tried to do both, and if life expectancy had stopped rising at the age of 74.5, it would have worked fine and they all would have deserved the pat on the back they gave each other for “saving the system”, but life expectancy did not stop at 74.5, and even though some say it will now stop at 79, we can't rely on that to actually happen. We need a system the will automatically adjust itself to any possible changes in life expectancy. Next - What is our life expectancy? |

||||||||||||||||||||||||||||||||||||||||||||||