Should I convert my Traditional IRA to a ROTH IRA?You are not required to take minimum withdrawals from funds held in a ROTH IRA account and any funds withdrawn from a ROTH account are also not counted when determining the taxability of your Social Security benefit. For these reasons the conversion of a Traditional IRA to a ROTH IRA will always give you more control of your savings during retirement. But, the degree to which the conversion is also profitable is largely dependent on your tax brackets before and after retirement. Caution: Check the current laws before you convert!

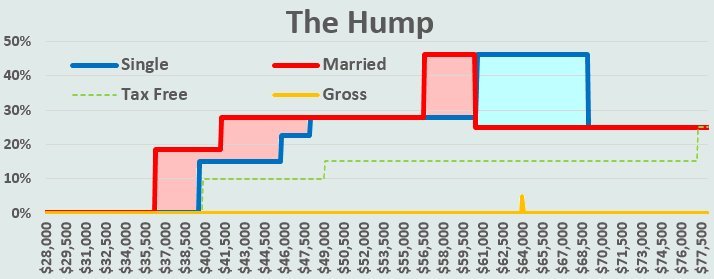

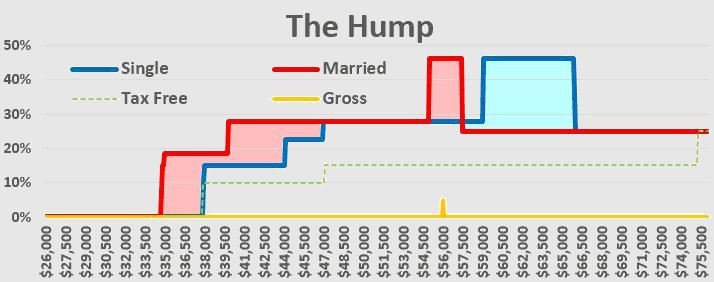

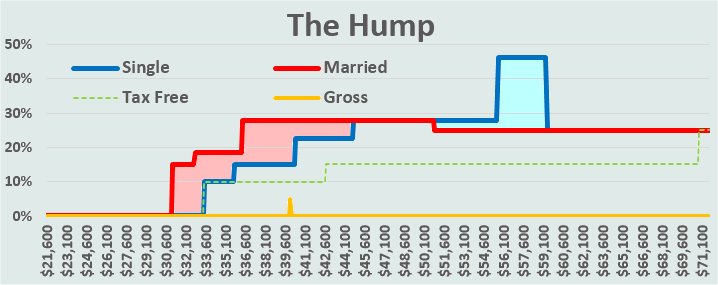

You are still required to pay your taxes on the amount you withdraw / convert from your IRA / 401K. If you can afford it, the payment of those taxes from an external source will give you the maximum benefit because it can be done in parallel with your annual ROTH contribution. The State taxes you pay will also be tax deductable that year allowing you to make an even larger conversion. The after tax line in this table illustrates what you end up with after a $10,000 conversion. The last two columns represent the "Effective Federal Tax Bracket" when you are paying taxes on a portion of your Social Security Benefit. The 46.25% bracket is the highest tax bracket that we pay, something that I call "The Hump" which we will discuss shortly. Letís do an example: You are single and the top of the 25% Federal tax bracket is $90,750 for 2015. You estimate that your taxable income, 1040 line 43, will be $60,250 after itemized deductions and your exemption. You can convert $30,500 of your Traditional IRA to a ROTH and not jump into the 28% tax bracket. If your State tax rate is 8% and you pre-pay the $2,440 tax due in 2015, then your itemized deductions will go up by that amount which allows you to convert that much more. Use the market to your advantage. Assume the market goes through a correction and drops 10% or 20%. Your holdings of XYZ dropped from $25,000 to $21,500. You donít want to sell low, you know the company, and believe the price will recover. So donít sell, convert it to ROTH. You can do the conversion in kind at $21,500 and only pay the taxes on that lower amount and then let it recover from the correction tax free. Examples of The HumpThe Hump is directly related to the question at the top of this page and we need to take time to look at a couple illustrations of how The Hump will effect your income during retirement before we continue. The Hump was created by the 1983 and 1993 amendments which made a portion of our Social Security benefits taxable income. For example, at certain income levels if you withdraw an additional $100 from your IRA account an additional $85 of your Social Security benefit becomes taxable and if you are in the 25% Federal tax bracket you will pay 25% of the total $185, $46.25, as taxes. Your Effective Federal tax Bracket is 46.25%. Our first illustration shows an individual or a married couple where the average individual was making $80,000 while working and now wants to retire on a total income of $64,000. 80% is a normal retirement goal since the pretax value of our Social Security and Medicare deductions is about 10% and we generally save an additional 10% in a 401K account.  The green dashed line indicates the normal tax bracket if none of the SS Benefit was taxed. The Red line shows the tax bracket of a married couple with each person averaging the amount at the bottom of the chart. The Blue line shows the tax bracket of a single person. Note the red areas of the chart, this is the marriage penalty. A married coupleís taxability brackets go up faster than a single person so they pay more taxes earlier. The blue area is the same size as the red area so everything equals out eventually. The tick on the bottom line highlights their $64,000 income level. The important thing to notice about the chart is the location of the tick on the orange gross income line. The married couple is already over "The Hump". The maximum 85% of their Social Security benefit has already been taxed so any additional withdraws are now taxed at 25% of the $100 only. The chart seems to indicate that their Hump started at about $56,500 which is $8,500 less than their gross income. They need to find a way to supplement their taxable income with $17,000 of tax free income as a couple to avoid paying any 46.25% taxes. If they had not planned ahead, the best way to do this is with a ROTH conversion. Another way might be to take out a reverse mortgage. The better way was to plan ahead and purchase a tax free annuity or have a taxable investment account where a large portion of the withdrawals will be tax free. The single individualís Hump seems to start at about $61,000 so that person only needs to find about $3,000 of non taxable income to avoid paying the 46.25% Hump taxes. The important thing here is not to merely convert just enough to ROTH to avoid the current 46.25% tax bracket, but to also realize that future inflation, COLAs, combined with the fixed $25,000 and $32,000 taxability points may very well push you into the Hump in the future. You also want to make room for increasing MRDs and any other unanticipated expenses that you might decide to take out of your Traditional IRA. Here is a similar chart for a person earning $70,000 who has the same 80% retirement goal of $56,000.  Their estimated Social Security benefit is about $26,000 at full retirement age so they need to supplement their income with an additional $30,000. The Humps are smaller because 85% of the smaller Social Security benefit is smaller and the orange tick shows that the single individual has not even reached The Hump yet. A ROTH conversion for the single individual would still be beneficial. There is a small savings when paying their 25% bracket before retirement instead of their 27.75% bracket during retirement. But an additional purchase of only $3,000 would put them at The Hump and any more would put them in it. The big advantage of a ROTH conversion is that they can rely on their tax free savings in case they have an emergency expense or decide to take an expensive trip. As we will see shortly, the census bureau said that the median family income was $51,939, so lets just about double that and look at The Hump for a married couple who were both working and earning $50,000 each.  The Hump does not even exist for this couple. Their conversion would still be profitable by paying 25% now instead of 27.75% during retirement. They could even go beyond that point and just do withdrawals than their MRDs to maximize their 18.5% bracket while letting their ROTH grow tax free. If however we were looking at a single person who earned $50,000 their retirement tax bracket is only 15%, 10% plus 50% taxable SS. You would have to do some personal calculations. Their 25% tax bracket starts at a taxable income level of $37,450. Ask the question, is it worth paying 25% now to avoid paying 15% during retirement? ConclusionBased on the third Hump illustration where a single individual has an earning level almost that of the median family income level, the answer to the conversion question is not a simple yes or no. The most important thing you can do when planning for and during retirement is to be aware of how "The Hump" will effect you during your retirement years and then plan to avoid its major impact. But a ROTH conversion remains an excellent tool to consider during your planning process. Note: The Taxation of your Social Security Benefits is only going to get worseThe Social Security amendment of 1983 established a formula used to determine your benefit taxability at the 50% level, you take half of your benefit and add the rest of your taxable income to get a basis. If that basis is over $25,000 for individuals and $32,000 for married couples, 50% of the amount over the basis becomes taxable until 50% of your total benefit has been taxed. The 1993 amendment created a $34,000 basis for individuals and a $44,000 basis for married couples, 85% of the amount over these secondary basis points becomes taxable until 85% of your total benefit has been taxed. Note: check the current laws closely when doing the calculations. Things like tax free municipal bond income is counted for SS taxation but not gross income after that. The census bureau said that the median family income in 1984 was $22,415, so starting the taxation at $32,000 and starting the 85% taxation at $44,000 allowed the government to say, purposely mislead us, that the laws were designed to "tax the rich". What they failed to tell us, no doubt it was on purpose, was that these basis points were fixed, COLA adjustments do not change them. The median family income in 2013 was $51,939 which is now nearly $8,000 over the 85% taxation level, no longer $22,000 below that level when they told us that the law was designed to "tax the rich". Inflation will continue to increase median incomes and SS benefits, so the problem of over taxation of the average family will continue to get worse. The one tool that we have to help us avoid this issue is our ROTH account. Money taken out of a ROTH is non-taxable and is not included when you calculate the basis for the taxation of your Social Security benefits. |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||